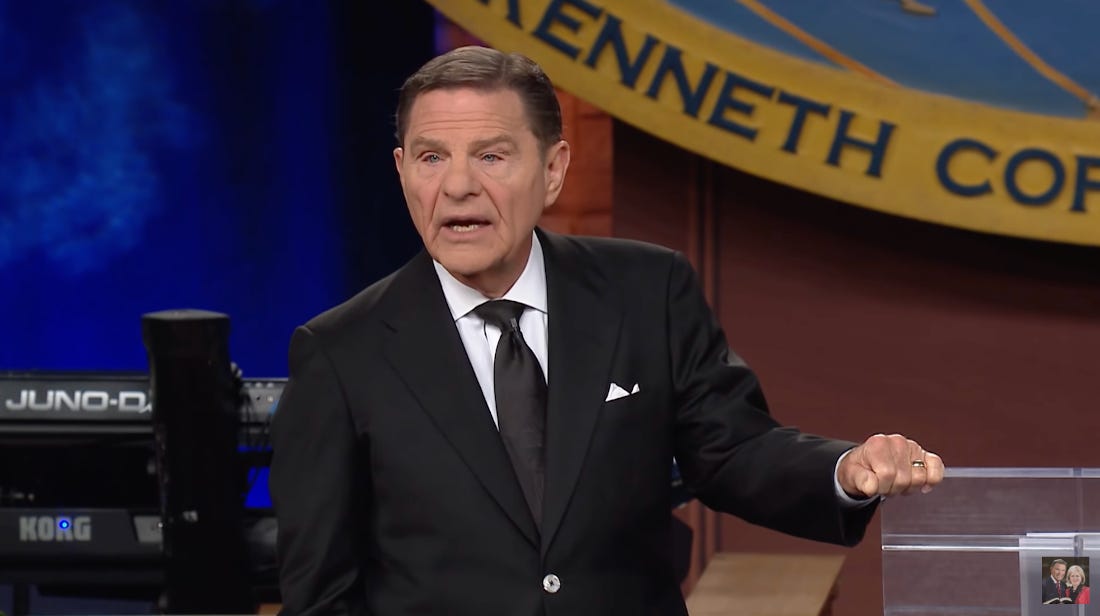

How Kenneth Copeland gets away with living in a tax-free mansion

This is a sign of a broken system.

Kenneth Copeland, arguably the wealthiest televangelist in the country with an estimated net worth of $760 million, pays less in property taxes than you do. At least by percentage.

Even if that $760 million number is incorrect, he has referred to himself in the past as a billionaire and his actual worth is undoubtedly much, much higher than it has any right to be. (There’s a reason so many of his stories involve private jets.)

So here’s a question: Why doesn’t this wealthy televangelist have to pay any taxes on the 18,000-square-foot mansion he lives in?

The Houston Chronicle’s Jay Root offers a frustratingly simple answer:

Under a little-known statute that county appraisers say is too vague and permissive, the $7 million mansion owned by Copeland’s Eagle Mountain International Church is considered a parsonage — a clergy residence — qualifying for a 100 percent tax break.

That means Copeland’s church gets a pass on what would otherwise be an annual property tax bill exceeding $150,000 — money that other local taxpayers must backfill to cover the cost of schools, police and firefighters.

Everyone suffers because of a legal statute that allows churches to claim any kind of living arrangement as a “parsonage” worthy of a tax break — not just a simple space where a pastor can live as he does the work of the church.

Is Copeland is cheating the system? Legally, no. He’s just taking advantage of a system that benefits people claiming to work on behalf of a religion.

This revelation is the fourth article in a series by Root, Eric Dexheimer, Stephanie Lamm, and their colleagues about how ministries have taken advantage of the tax code. In theory, religious ministries offer a service to the public, which is why they get a reprieve on taxes. (The same applies to other non-profit organizations as well.) That’s also true of pastors’ homes; they don’t usually get paid hefty salaries, so giving them tax breaks on their homes is a way to help out those in the profession.

The problem is that many churches use the law — and their status as a religion — to line their leaders’ pockets while depriving their communities of much-needed revenue for public resources.

So far, the investigation of the most populous counties in Texas has found “2,683 parsonages worth about $1 billion, costing other residents who must fund school districts and local governments $16 million every year.”

The Problems Are Bigger In Texas

Just consider the law in Texas: Technically speaking, there’s a one-acre limit on what qualifies as a “parsonage.” Anything beyond that, and you have to pay property taxes.

The law also says religious leaders shouldn’t use the tax break for “private gain”… though that term is never defined. (You could argue that anything that benefits the pastor ultimately benefits the ministry.)

Furthermore, while other states limit the number of parsonages a church can claim (In New Jersey, it’s two; in Tennessee, it’s one), Texas has no limit. So a megachurch could theoretically apply for dozens of tax-exempt homes for its leaders.

Still! One acre limit! That’s pretty straight-forward! So how does Copeland evade paying his fair share of taxes on a 25-acre piece of property?

The luxurious 1-acre parsonage is surrounded by a 24-acre lakefront tract valued extraordinarily low – $125,000 – so Copeland’s Eagle Mountain International Church pays less than $3,000 a year in property taxes on it, records show. The district agreed to the value as part of a dispute resolution agreement with the church, Law said.

Real estate experts say that much waterfront property minutes from Fort Worth would sell for many multiples of that on the open market.

“Texas law states that the parsonage exemptions are limited to an acre,” [Trinity Foundation President Pete] Evans said. “Copeland's mansion is like a textbook example on how lawyers can get around the spirit of the law, using the letter of the law.”

The Chronicle goes on to say that, by calling itself a church, Copeland’s 1,400-acre Eagle Mountain International Church and surrounding properties — worth about $60 million — only have to pay about $23,000 in taxes. (“That’s about what the owner of a $1 million home might expect to pay in taxes in Houston.”)

The last time the ministry was even asked to reapply for the parsonage exemption was 23 years ago. They’ve been coasting for decades on a decision that never should have gone their way.

It’s not just Copeland.

The Houston Chronicle’s examination of Texas parsonages identified more than 30 tax-free clergy residences larger than 1 acre. The homes collectively represent millions of dollars in value.

How does that happen? The appraisers whose job it is to oversee this sort of thing didn’t do their due diligence. Their staffers just signed off on whatever pastors asked for. As one appraiser put it, “Most applications never make it to my level. They just get approved.”

Interesting side note: Pastor Joel Osteen — another wealthy pastor in Texas who’s taken his share of (well-deserved) heat — lives in his own 15,000-square-foot home. But the Chronicle found that, unlike Copeland, Osteen didn’t ask the Harris County appraiser for a tax break. He pays about $218,000 a year in property taxes.

He shouldn’t be praised for that. He’s doing what he ought to be doing in this regard, since there’s no reasonable argument to be made that he deserves a tax break on his mansion. Still, it feels like a big deal, doesn’t it?

Some Ministries Are More Equal Than Others

Copeland should also be paying taxes for his private jets, but he managed to evade that, too, by simply refusing to tell county officials in 2008 what salaries he was paying everyone associated with the aircraft. He even used the same argument that shields plenty of megachurch pastors from disclosing their salaries: It’s confidential.

Instead of demanding he tell the county the relevant salaries — which would make it all public information — officials agreed to accept an affidavit from the church’s CPA saying the salaries were “reasonable.” Whatever the hell that means.

To put all that another way, one reason Copeland is able to avoid paying his fair share of taxes is by refusing to give government officials the information they need to hold him accountable. It’s a completely perverse system that benefits religious leaders who have no qualms about hiding their true intentions.

Copeland himself doesn’t even have to abide by the standards of other churches.

Other churches have faced far more scrutiny. Some have been asked periodically to reapply for their parsonage exemption. And in letter after letter to clergy residence applicants, the appraisal district in Fort Worth warns religious organizations they will lose their exemption unless they say who lives there and how they’re connected to the ministry.

“Give the name of the person who resides at this property. Where did this person live before moving to this location? Give the name and location of the church,” the Tarrant Appraisal District demanded in a letter to New Hallelujah Church in 2010. “Unless you furnish this information within thirty days … the exemption must be denied.” The church complied.

For some reason, Copeland’s ministry doesn’t have to tell anyone who lives at his home, how they’re connected to his ministry, or anything else.

A Path Forward

If there’s any silver lining here, it’s that the Chronicle’s reporting has resulted in 13 different appraisal districts saying they would review the parsonages in their jurisdictions to see if they need to be paying more. If an exemption is overturned, or is discovered to have been granted erroneously, state officials can recover “up to five years’ worth of unpaid back taxes.” For people like Copeland, that’s a lot of cash on the line.

I would be shocked, though, if Texas officials managed to get wealthy preachers to give up even an ounce of their unearned privilege.

Just look at how McLennan County Chief Appraiser Joe Don Bobbitt just completely dismissed the idea of going after churches:

McLennan County’s Bobbitt said he would ask the district’s unqualified parsonages to separate their parcels into two properties: a tax-free 1-acre parsonage, with the remainder going back on the rolls. But, he said he had no appetite for an unpopular back-tax fight.

“We’ve clawed back on some properties, but not religious,” he said. “Our thinking is that we should have caught it if it’s more than 1 acre, so we’re not going to penalize them.”

So county officials screwed up and churches benefitted. But county officials won’t face any punishment, and the churches won’t have to pay any kind of penalty (or, more accurately, pay back what they owe the community). Again, these are completely perverse incentives. What’s stopping these officials from accidentally overlooking other church requests for tax exemptions in in the future? Nothing.

By not holding pastors accountable, though, the onus is on everyone else to pay even more for schools, cops, firefighters, hospitals, and other public resources. When wealthy scamvangelists don’t pay property taxes, everyone else may see higher sales taxes. Everyone else suffers because a bunch of religious leaders are more interested in elevating themselves than helping others. It’s everything that’s wrong with religion in a nutshell.

(Screenshot via YouTube. Thanks to Tim for the link)

The system isn't broken, it was designed that way. Tear it down and start over.

Osteen can afford it. He's got so much money that he has to stash some of it in the walls.

Y'know, "be a better human than Joel Osteen" is a pretty low bar. Subterranean, even- the guy's absolutely terrible.

But somehow I'm still not surprised that Copeland failed to clear it.